Why Purchasing Cancer Insurance Is Worth The Investment

Posted on June 28th, 2024

Cancer treatments often lead to overwhelming bills that extend far beyond what regular health insurance covers.

Chemotherapy, radiation, surgery, and medications can quickly add up, sometimes amounting to hundreds of thousands of dollars.

Moreover, it’s not just about covering treatment costs. Many families struggle with incidental expenses that standard health insurance doesn't touch.

Beyond medical expenses, cancer insurance covers a range of other costs that might not immediately come to mind. Professional childcare, for instance, can be a major concern for young parents undergoing treatment.

Rather than choosing between focusing on recovery and spending quality time with their children, a robust cancer insurance policy can help cover these additional care costs. By addressing these varied needs, cancer insurance allows you to focus on what truly matters: your health and your family’s well-being.

Think about how you'd manage indirect costs such as loss of income. Treatment often necessitates time off work, which can lead to a significant reduction in household income. Imagine if you had to cover mortgage payments, rent, utility bills, and groceries while facing this loss. Cancer insurance helps fill in the financial void, offering benefits that maintain your living standards without causing a compromise on significant financial commitments. Home care services, whether for the patient or for family members suddenly burdened with caregiving responsibilities, are another essential aspect often covered by cancer insurance.

When deciding whether cancer insurance is the right investment for your family, consider several key factors. Reflect on your family’s medical history and current health status. Even if you’re in good health now, cancer can strike unexpectedly. Assess your financial situation: can your savings and income comfortably absorb the unexpected high costs of cancer treatment? Stories from families in San Jose highlight the immense benefits they gained from their policies, enabling them to focus on treatment and recovery without the constant worry of financial strain.

Researching the best cancer insurance policy is crucial. Seeking for an advice from a trusted advisor and reading consumer reviews can provide valuable insights. Ensuring you have comprehensive coverage allows you to focus more on healing and less on medical billing intricacies. By making an informed decision, cancer insurance can become a key pillar in securing your family’s financial future.

Protection Against Financial Burden

Cancer insurance is a crucial tool in reducing the financial strain brought on by the high costs of affording cancer treatments.

Cancer treatments can lead to overwhelming bills, even for those with regular health insurance. For example, costs related to chemotherapy, radiation, surgery, and medications can quickly add up to hundreds of thousands of dollars.

Diagnostic tests and continuous follow-up appointments further escalate these expenses. This was the case for a client from Livermore who, despite having health insurance, faced $75,000 in out-of-pocket expenses for a year of treatments. Imagine the significant impact on your savings and day-to-day living expenses without an adequate financial plan.

Having cancer insurance provides a vital financial safety net, enabling you to focus on recovery and maintaining your quality of life without the constant worry of medical bills draining your resources.

In addition to covering treatment costs, cancer insurance helps manage other related expenses that aren't typically covered by standard health insurance policies.

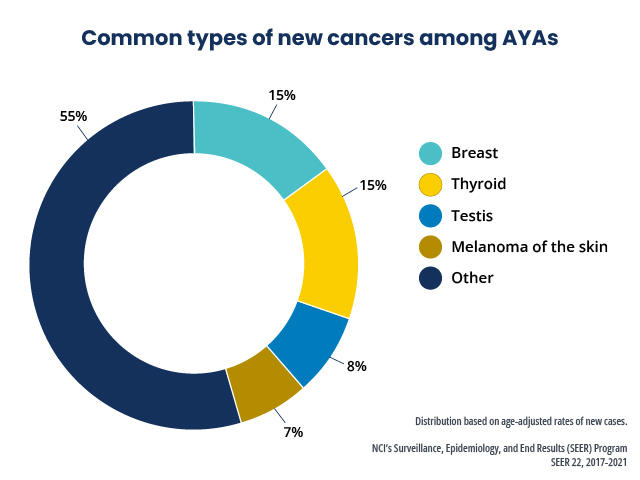

Did you know that in 2024, approximately 84,100 adolescents and young adults (AYAs) aged 15 to 39 in the United States will receive the devastating news of a cancer diagnosis?

This alarming statistic makes up about 4.2% of all cancer diagnoses. With such a high number of young individuals being diagnosed with cancer, having a comprehensive cancer insurance policy is a must.

Don't leave yourself or your loved ones vulnerable to the financial burden that comes with a cancer diagnosis.

Invest in a cancer insurance policy to ensure that you have the necessary support and resources to fight against this disease.

That's why cancer insurance is essential for anyone looking to fortify their financial future against the unexpected.

Comprehensive Coverage Benefits

The benefits of cancer insurance go far beyond covering just medical expenses. Many people overlook the comprehensive coverage benefits that extend across various aspects of life impacted by a cancer diagnosis. A major benefit, for instance, is addressing travel expenses for specialized treatment.

There are instances, such as the case with a family in Oakland, where state-of-the-art treatments are available only out of state. This necessitates travel, and often, prolonged stays away from home. The costs can be substantial when you consider airfare, accommodations, and even daily expenses like meals. A robust cancer insurance policy typically covers these travel-related costs, sparing families from additional financial stress during an already challenging time.

Additionally, childcare can be a major concern. Many patients are young parents who face the dilemma of managing time between treatment and their children's needs. Rather than choosing between focusing on recovery and spending quality time with their children, cancer insurance helps cover the costs of professional childcare, ensuring that kids are looked after while you get the care you need.

How does cancer insurance work? It provides a holistic shield against various indirect costs, such as loss of income. Cancer treatment often necessitates time off work, whether it's for frequent hospital visits, undergoing rigorous treatments, or simply taking time to rest and recover. For many, this means a significant reduction in household income, especially if the primary breadwinner is affected. Imagine a scenario where mortgage payments or rent, utility bills, and grocery expenses continue to accumulate.

Cancer insurance steps in to fill this financial void. It offers benefits that cater to the immediate need for maintaining everyday living standards without causing a compromise on major financial commitments.

Furthermore, families may need home care services to assist in recovery, either for the patient or the family members affected by the added responsibility of caregiving. These services, which can be immensely costly, are also covered under many cancer insurance policies. By addressing these diverse financial aspects, a cancer insurance policy ensures that the overall burden on a family is significantly eased, allowing all to focus more on the emotional and physical aspects of recovery. Knowing that your family is financially safeguarded provides immeasurable peace of mind, making cancer insurance not just a financial tool but a crucial element for overall well-being and stability.

Evaluating the Worth

Evaluating the worth of cancer insurance necessitates considering both the comprehensive protection it provides and the real-world financial impact it can have on individuals and families. One of the most critical aspects to understand is how cancer insurance helps manage not only the medical bills but also the significant incidental costs that often accompany a cancer diagnosis. While health insurance may cover a portion of medical treatments, it often leaves substantial out-of-pocket expenses.

Statistically, those with cancer insurance often fare much better financially during their treatment journeys. A study by the American Cancer Society revealed that families without cancer-specific insurance are 2.5 times more likely to face severe medical debt.

This sharp contrast highlights the policy’s substantial value. When you think about the potential months or even years off work, cancer insurance provides vital support, equivalent to income replacement, ensuring your family's financial stability.

You might wonder if cancer insurance is a necessary expense, but when you evaluate the full spectrum of benefits and compare it against potential costs without it, the investment becomes evidently worthwhile. Hence, when deliberating on securing your financial future, incorporating the best cancer insurance policy can be a prudent step in ensuring comprehensive protection and peace of mind during one of life’s most challenging times.

Making the Decision to Invest

Making the decision to invest in cancer insurance isn’t just about assessing the immediate costs; it’s about considering the broader scope of your financial health and future stability. You should evaluate several factors before concluding whether purchasing cancer insurance aligns with your personal and family needs.

Firstly, consider your family medical history. If there’s a history of cancer within your family, this could increase the likelihood of a similar diagnosis for you, solidifying the need for that additional layer of protection. Secondly, reflect on your current health. Even if you’re in excellent health now, the incidence of cancer is unpredictable.

Taking a proactive approach can save significant stress and financial burden later. Additionally, assess your financial situation. Look at your savings, income, and current expenses. Can your financial resources comfortably cover unexpected, high costs of cancer treatment or would this strain your finances? The real-life impacts can be seen through stories like that of a family in San Jose, who despite good health insurance, faced overwhelming out-of-pocket expenses when cancer struck.

Another client from Sunnyvale benefited immensely from their cancer insurance which covered costs well beyond what their health insurance offered. This enabled them to focus on treatment and recovery without the constant worry of depleting their savings.

To find the best cancer insurance policy, it is crucial to perform diligent research and compare various policies. Start by examining coverage levels—what does each policy specifically cover in terms of treatments, medical consultations, and emergency services?

Likewise, investigate additional benefits like payouts for travel, lodging, and home care services. Real-world examples, such as a family in Walnut Creek that had to seek specialized care out-of-state, highlight how these additional benefits can be a lifeline.

Furthermore, scrutinize the policy terms—understand the waiting periods and any exclusions that may apply. Ask yourself specific questions like, “why buy cancer insurance” and “is cancer insurance necessary” based on your situation.

Consumer reviews and a consultation with a trusted insurance advisor can also provide valuable insights into which policy might best suit your needs. It's not just about immediate monetary value but also long-term security and peace of mind. Cancer insurance steps in as a financial bridge, reducing the potential for medical debt and protecting your household from significant financial strain.

Ensuring you have a comprehensive support system in place empowers you to focus on healing and family, rather than the intricacies of medical billing. With thorough evaluation and informed decisions, investing in cancer insurance can become a key pillar in securing your family’s financial future.

To Conclude

Investing in cancer insurance isn't merely a financial decision; it's an act of caring for yourself and your loved ones. The peace of mind knowing that your family won't face financial turmoil if a cancer diagnosis arises is invaluable. Undoubtedly, preparing now can save you from stress and significant financial strain later. Don't wait until it's too late. Protect yourself and your loved ones with cancer insurance from Epiphany Benefits & Insurance Services, Inc.

Contact me today to learn more about my cancer insurance plans and how I can help you protect your financial future. Call 510-421-4345 or email [email protected]. I'm here to provide the guidance and support you need.

Contact Me

Get in Touch With Us Today

Ready to secure your financial future? Connect with our team at Epiphany Benefits & Insurance Services Inc. today!